In the fast-paced and highly regulated world of banking, maintaining accurate, consistent, and up-to-date data is paramount for success. Master Data Management (MDM) emerges as a critical tool for banks to manage their vast and diverse data assets effectively. MDM encompasses the processes, governance, policies, and technologies that ensure the uniformity, accuracy, stewardship, semantic consistency, and accountability of the enterprise's official shared master data assets. Let's explore some compelling business use cases of MDM in the banking industry through real-world scenarios:

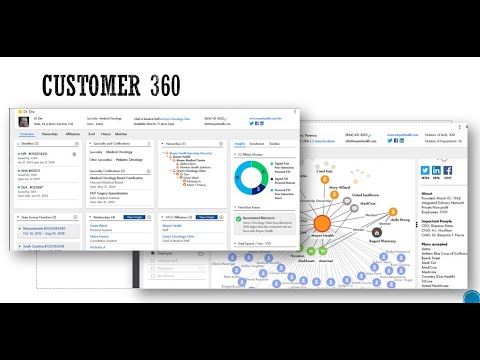

Customer Data Integration and Single View: Scenario: A customer interacts with various touchpoints across multiple channels, such as branches, online banking platforms, mobile apps, and call centers. However, due to siloed systems and disparate data sources, the bank struggles to maintain a unified view of the customer, leading to fragmented and duplicated records.

MDM Solution: By implementing MDM, banks can integrate customer data from disparate systems and channels to create a single, comprehensive view of each customer. This consolidated view enables personalized marketing, targeted cross-selling, improved customer service, and enhanced risk management.

Risk Management and Compliance: Scenario: A bank operates in a highly regulated environment and must comply with a myriad of regulatory requirements, such as KYC (Know Your Customer), AML (Anti-Money Laundering), and GDPR (General Data Protection Regulation). However, inconsistent or inaccurate customer data across systems increases the risk of regulatory non-compliance and exposes the bank to financial penalties and reputational damage.

MDM Solution: MDM enables banks to establish a centralized repository of high-quality customer data, ensuring compliance with regulatory standards and minimizing the risk of financial crime. By maintaining accurate and up-to-date customer information, banks can mitigate compliance risks, improve fraud detection, and enhance regulatory reporting.

Product and Service Innovation: Scenario: A bank seeks to introduce new products and services tailored to the evolving needs and preferences of its customers. However, disparate product data, redundant processes, and data inconsistencies impede product innovation and time-to-market.

MDM Solution: Leveraging MDM for product data management enables banks to streamline product development processes, harmonize product information across channels, and accelerate time-to-market for new offerings. By maintaining a centralized product catalog with consistent and accurate data, banks can drive innovation, enhance customer experience, and gain a competitive edge in the market.

Cross-Selling and Upselling: Scenario: A bank aims to increase revenue by cross-selling and upselling financial products and services to existing customers. However, without a comprehensive understanding of customer relationships and preferences, the bank struggles to identify relevant cross-selling opportunities and deliver targeted offers.

MDM Solution: By leveraging MDM to create a unified view of customer relationships, transaction history, and product holdings, banks can uncover valuable insights into customer behavior and preferences. This enables banks to segment customers effectively, tailor offers based on individual needs, and execute targeted marketing campaigns to drive cross-selling and upselling initiatives.

Data Governance and Quality Management: Scenario: A bank grapples with data inconsistencies, errors, and redundancies across its systems and processes, leading to operational inefficiencies, decision-making delays, and increased operational costs.

MDM Solution: Implementing robust data governance frameworks and data quality management practices through MDM ensures the integrity, accuracy, and completeness of critical data assets. By establishing clear policies, standards, and procedures for data stewardship, data quality monitoring, and metadata management, banks can improve data governance maturity, enhance data quality, and drive better business outcomes.

Master Data Management emerges as a strategic imperative for banks seeking to thrive in today's dynamic and competitive landscape. By harnessing the power of MDM, banks can unlock the full potential of their data assets, drive operational excellence, mitigate risks, and deliver superior customer experiences. As the banking industry continues to evolve, MDM will remain a cornerstone of digital transformation, enabling banks to innovate, differentiate, and succeed in the digital era.

Learn more about Master Data Management here

No comments:

Post a Comment

Please do not enter any spam link in the comment box.